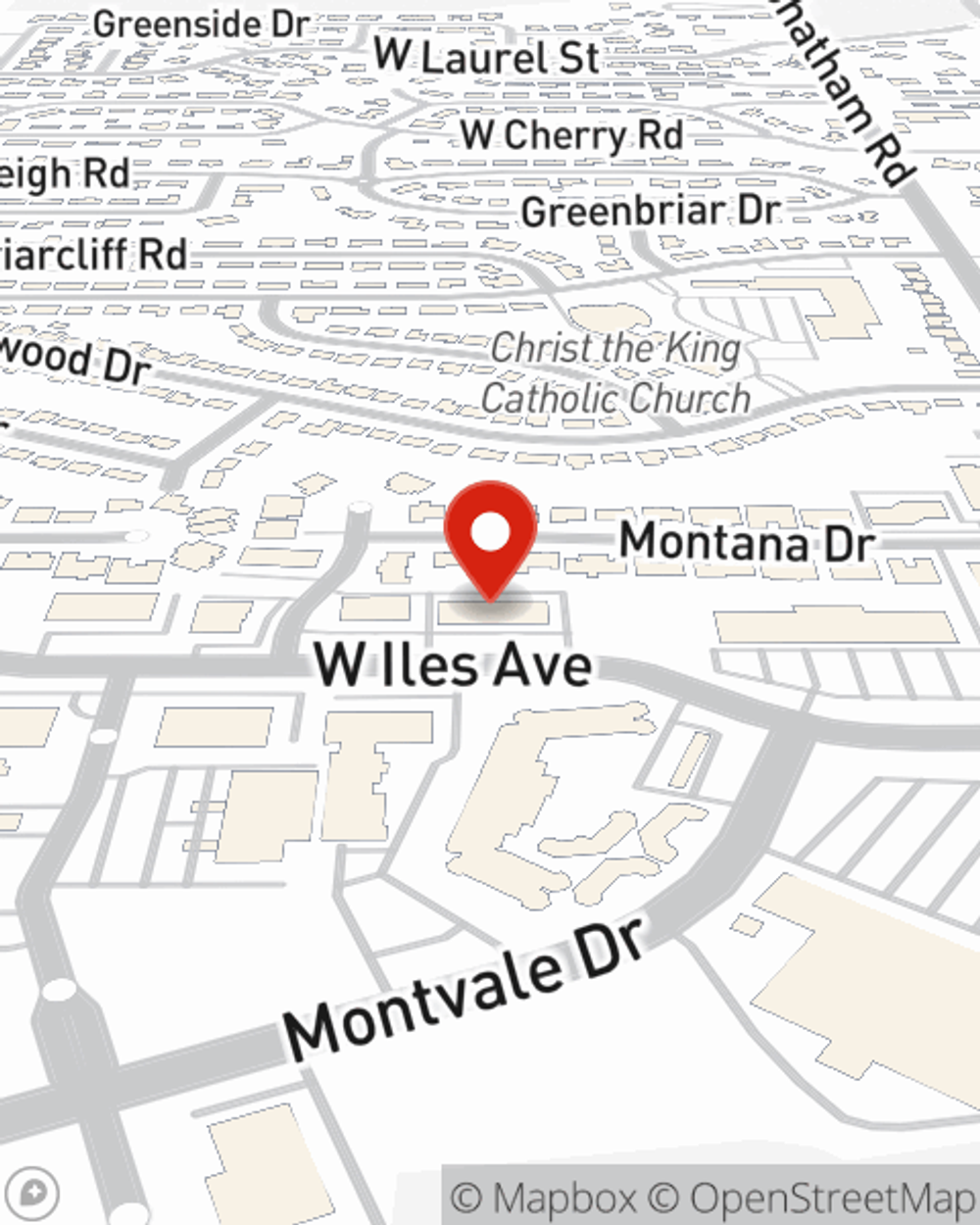

Business Insurance in and around Springfield

Searching for coverage for your business? Search no further than State Farm agent Brady Schroeder!

This small business insurance is not risky

Cost Effective Insurance For Your Business.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home improvement store, a cosmetic store, a tailoring service, or other.

Searching for coverage for your business? Search no further than State Farm agent Brady Schroeder!

This small business insurance is not risky

Surprisingly Great Insurance

Your business thrives off your passion creativity, and having dependable coverage with State Farm. While you support your customers and make decisions for the future of your business, let State Farm do their part in supporting you with business owners policies, worker’s compensation and commercial liability umbrella policies.

As a small business owner as well, agent Brady Schroeder understands that there is a lot on your plate. Call or email Brady Schroeder today to discover your options.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Brady Schroeder

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.